Originally published May 2012

Where to begin…

The chances of this being read by anyone are incredibly slim. I am not a reporter. I am not an economist. I am not anyone with any kind of fame. I am a CPA and energy analyst. Still, for my own sanity I would like a public, published record of what I have been saying for over a year now: there is a very real chance that the Chinese economy will not meet growth expectations. Why this viewpoint has not even been heard by most people, let alone agreed with, is incredibly peculiar to me. Is it because Chinese growth is considered so vital to global economic health given austerity measures in Europe and tenuous growth domestically? Is the thought that China could slow down (let alone go into recession) so frightening that no one dares breathe the word? Is there some incredible phenomenon of groupthink occurring? Are people afraid to be the only person who voices an opposing opinion?

In an age where people take outlandish stances purely for some degree of notoriety and iconoclasm, few people raising legitimate concerns regarding the almost universally held belief of sustained Chinese growth is amazing. The key to the whole issue is this: the Chinese economy is based on growth, not profitability. The Chinese government invests tremendous time and resources to expand its growth and sphere of influence. So long as the growth continues as it has recently, everything is fine. If it does not, the economy begins to resemble a Ponzi scheme and everything falls apart. There are some areas of concern regarding the sustainability of this growth. For ease of reading I have attempted to group them into two main categories, although they are absolutely intertwined and overlap with one another.

Costs

China has had one main competitive advantage in recent memory: low cost of production. For goods that required less worker expertise, artificially low wage rates and other low cost factors allowed China unmatched cost to productivity ratios. But the landscape is changing:

- Chinese wage rates increased 150% from 1999 to 2006 and are increasing at a rate of 15-20% per year. Per the Boston Consulting Group, this will reduce China’s labor cost advantage from 55% to 39% by 2015.

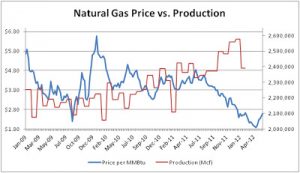

- Asian market LNG (liquefied natural gas) prices range from $12-16 while domestic natural gas prices have been hovering between $2-4 (the sustainability of which is another discussion altogether). Asian LNG prices will only continue to go up as Japan continues its nuclear phase-out and continues to import additional LNG. This naturally means shipping and energy costs will increase for Chinese produced products.

- Chinese land prices are increasing.

- Indonesia and other nations are increasing their capabilities and are cost-competitive with Chinese goods.

So we can see that the Chinese cost advantage has taken a major hit and will likely continue to do so. But the story does not end there.

Demand

China is not a usable resource rich nation. Supposedly massive shale resources will not be able to be utilized because water is so scarce in most parts of the nation. This leaves China to use its lower quality coal reserves, import higher quality coal from Australia and the U.S., and import oil and LNG from neighboring Arab nations.

So what is a nation to do when it does not have the ability to export natural resources and wishes to grow? It has a few options. It can export services (as India sometimes does). It can attempt to be self-sufficient and live in isolation (North Korea and apartheid-era South Africa). Or it can import raw goods, transform them, and attempt to sell the finished product. This has obviously been the Chinese approach and has worked well for some time. But consider the environment in which the Chinese economy now operates.

Chinese domestic demand cannot begin to match its production. This necessitates significant exports to other countries, mainly the U.S. and Europe. The current Eurozone crisis (that has too many factors to even begin to discuss here) threatens the whole global system. This bleeds over into the U.S. where recovery has been mixed. And when economic conditions and the outlook are uncertain, those without employment have hardly anything to spend and those who are employed have a decreased MPC. In the wake of decreased demand, Chinese exports not only need to be sustained, they need to grow in order for their GDP to increase.

This does not even begin to mention the oftentimes strained relationship between China and some of its consumer countries. Recently, China not following EU trade sanctions against Iranian oil exports led to tense conversations between the countries involved. Differences in governmental and human rights ideologies frequently put China at odds with the U.S and EU. If any of these things ever caused a significant rift between China and one of its main consumers, it would have no other means to recover the loss.

Combined Effect

The combination of these factors leaves China in a very unpleasant situation. Japan of the 1990s looked very similar to the China of today. Growth was exploding at historic rates, its influence was expanding, and by all counts Japan looked to be the next global superpower. Then the economic outlook worsened, growth slowed, and the economy collapsed. That is not a forecast of what will happen to China today, but it does highlight the possibility and reason for concern.

The one way China could help guarantee sustained growth would be to have guaranteed demand. With global demand decreasing, China would need to capture a greater portion of overall demand by making sure their goods are the lowest cost. Historically this would be done by deflation, wage reductions, and general slowdown. The problem? Growth and inflation go hand in hand. China simply cannot effectively combat inflation while trying to grow at ~9% per year. This means wages will continue to rise, which takes away its main competitive advantage, which only further reduces demand. And if demand falls, so does the nation.

Again, this is not a prediction of what will happen. This is not me looking into a crystal ball to tell the world China’s fate. China may very well continue to grow and the economy continue to be stable. This is simply to highlight that the almost unanimously held belief that China will undoubtedly and absolutely grow and expand is far from true.