Originally published September 23, 2013:

Okay, maybe it’s not a tax deadline in the strictest sense of the word, although there are some important cut-off dates coming up as early as October 1 (more on that in a minute). However, let’s step back for a moment here and look and the important “bigger picture.” Once the year is over – and that is not that far away – most opportunities to be proactive and implement tax-saving strategies for 2013 tax year will be gone. And that means you will be stuck with the tax consequences of just guessing and hoping instead of the benefits of intelligent planning.

So there IS a deadline – the planning and strategizing deadline. The chance to do things now to avoid unnecessary taxes in April.

“Planning is bringing the future into the present so that you can do something about it now” – Alan Lakein

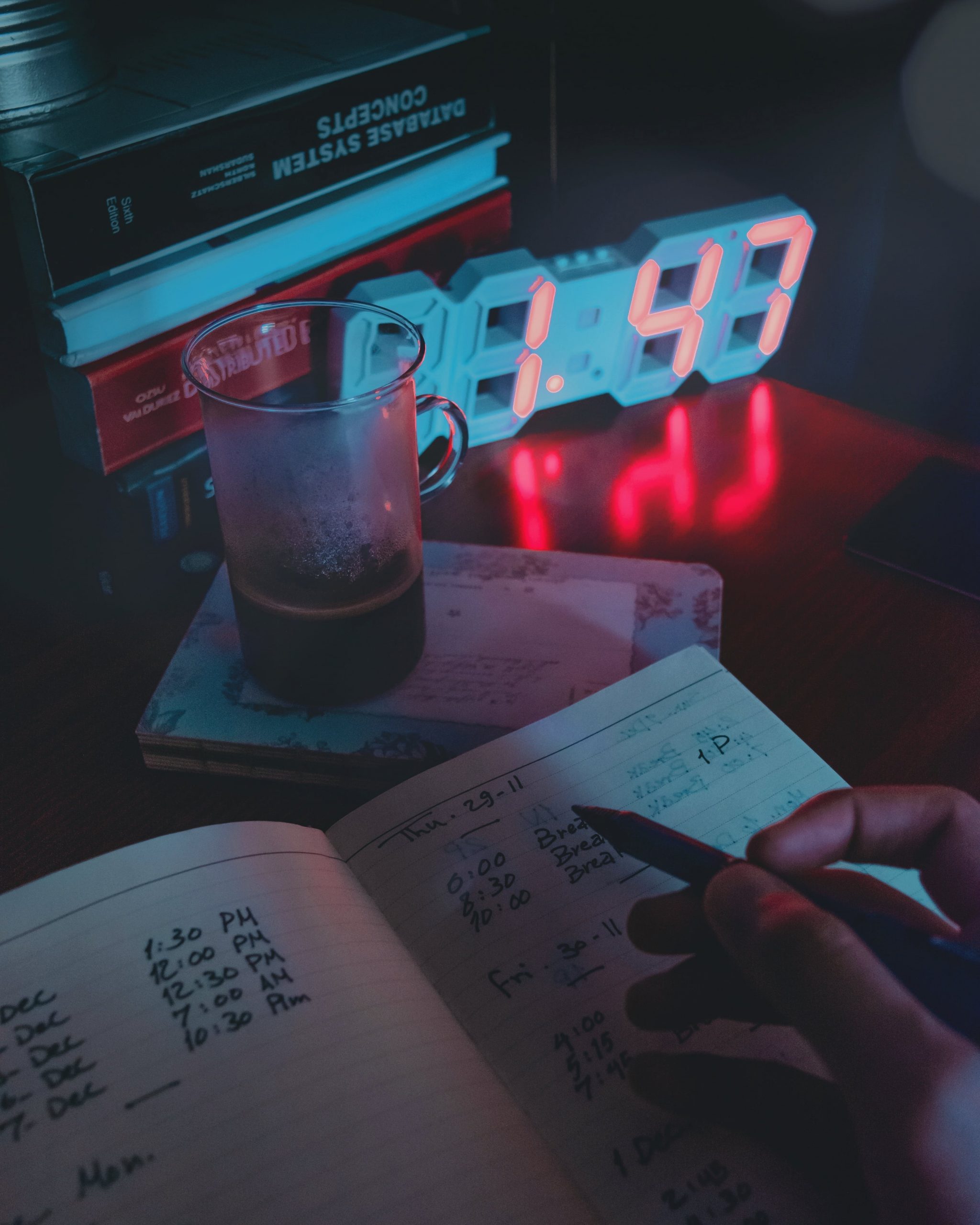

Stated less elegantly, I’m putting out the call for you to engage in some important planning and strategizing now so that you don’t end up doing this at tax time:

A few tips and examples of strategies that we can implement:

1. Income acceleration for those having a bad year in 2013 and income deferral for those with profits for 2013

Is 2013 shaping up to be a good income year? Better than 2014? Then perhaps you should consider how you can defer income into next year.

Conversely, if 2013 is showing a loss or smaller profit/earnings than you anticipate having next year, we can look at legitimate strategies to defer some expenses until next year and accelerate income into 2013.

This approach does not apply solely to businesses, either. Individuals also have flexibility in the timing of charitable deductions, scheduling and payment of medical expenses (within reason), deductible expenditures, sale of securities for losses or gains, and a number of other items.

Obviously, the best approach will depend completely on your own personal situation – income and business-wise. But having the necessary information available and doing a thorough analysis is the key. I can assist you looking at year-to-date figures, doing projections regarding next year, and reviewing other items to see which strategy is the best for you.

2. Monitor your flexible spending accounts (FSAs)

Flexible spending accounts (FSAs) are fringe benefits that many employers provide to employees for use in paying medical expenses. Employers save on their half of FICA taxes and employees receive the money pre-tax which effectively reduces the cost of the medical items purchased.

The downside is that you have to “use it or lose it”. Contribution amounts are decided at the beginning of the year. If you still have a balance at the end of the year, the amount is lost. Make sure to check your balance to see if there are appointments or supplies you can use the money towards.

3. Get organized

It sounds simple. In reality, it is simple. But everyone puts it off. People hate records, they hate accounting. (I’m an aberration, I know – I like accounting.) However, not keeping track of your records not only makes things stressful and hectic come tax time – it also makes it impossible to avail yourself of almost all of the tax strategies mentioned here. Getting organized will give you a true idea of how your individual situation is shaping up and will let us plan accordingly. In addition, most CPAs (myself included) will give you a small break on your tax bill if your records are nice and clean!

4. Do a “tax estimate underpayment check-up”

Make sure that you are sending enough in estimated tax payments to avoid penalties. Play catch-up if needed. Depending on your situation, the IRS may assess you with a penalty for not paying your tax liability evenly, but do not ignore the problem. The general guidelines to avoid underpayment penalties are:

- If your income is less than $150,000 ensure your estimated payments are at least 100% of the total tax that you paid in the previous tax year.

- If your income is more than $150,000 ensure your estimated payments are at least 110% of the total tax that you paid in the previous tax year.

- If you can correctly estimate your income for the current tax year, pay at least 90% of the tax that you will owe

5.A deduction checklist/review

We get so busy with our lives and businesses it can be easy to let things slip through the cracks. That is why it is good to have a checklist of deductions and expenses. If we have that prepared before the year ends, the chance of items being missed or forgotten come filing time is dramatically reduced. Forgetting one expense or deduction that you are rightfully due (or not even knowing about it in the first place) could cost you thousands. Take the time and plan now!

6. Do a Roth IRA conversion evaluation

If you are not making much money this year (you have a new start-up business, your business had experienced a slow year, you’ve been laid off, etc.) and have a traditional IRA or money in another retirement plan the conversion could be effectively tax-free (or at least partially so). Roth IRAs are the best deal going for many people – BUT a conversion at the wrong time can create a big tax liability. Doing the conversion at the right time gives you the best of all worlds – you got the deduction deferral when you needed it (when earning) and then you covert it when the tax consequences are small (or non-existent).

The key to this is to have someone review your YTD figures, current value of your retirement account, and other factors to see if this is the best option for you. NOTE: You can’t roll directly from a 401(k) or similar plan directly to a Roth IRA. If the 401(k) does not offer a Roth conversion option, you have to roll to a regular IRA and then convert. This takes time. Given that the end of the year is fast approaching, this is a very time sensitive issue. If you are considering this type of move, contact me as soon as possible to get the ball rolling.

7. “Section 179” and “bonus depreciation”

Okay, don’t panic if you have no idea what those terms mean. That’s what I’m here for. The number of possibilities under the first section of this article are almost endless and thus are too numerous to go into. But one that does warrant specific mention is equipment purchase and depreciation. If your business is having a very profitable year and needs equipment, a well-timed purchased can serve as an invaluable tax saving tool. However, the rules that go into the decision are constantly changing. Give me a call so we can talk about making the right purchase and at the right time.

8. Retirement plans

Contributing to a retirement plan can save you a significant amount in taxes. And even apart from this, doing so is an important part of planning your financial future. However, choosing the right type of plan for your business can be confusing. SEP-IRA, 401(k), SIMPLE-IRA, traditional IRA, etc. Furthermore some retirement plans have to be established and set up by OCTOBER 1 (although you can put the money in later.) Don’t miss out. Call me to evaluate your company’s needs and your personal requirements. I can put you in touch with qualified retirement plan investment advisors or provide information to you current advisor, once we determine which type of plan is best for you.

9. Hire your kids

In certain situations, you can hire your children to work for your business. If structured correctly, your children’s earnings will not be taxed as the same rate as your income. However, I caution people that this needs to be done carefully. The total amounts paid, the rate of pay, the work done, the legal structure of your business – all of this can affect whether or not this is a legal and viable strategy. Give me a call if you are unsure if you should pursue this idea.

10. Hire your spouse

With the impending healthcare reform changes, this may be subject to change but individual healthcare plans have historically been more expensive and difficult to get qualified for than group plans. Even if you do not have other employees, you can hire your spouse. This has the potential for significant tax savings. I can set you up with some qualified insurance agents who can help find the optimal solution for you. Additionally, in some cases there can be future Social Security income benefits from having income earned by your spouse rather than you.

11. An Alternative Minimum Tax (AMT) check-up

AMT was originally designed to target wealthy taxpayers by limiting/negating some of their deductions to ensure they were paying a reasonable rate in taxes. However, this is increasingly affecting the small business owner. Planning ahead of time can help you anticipate and reduce AMT issues and potentially save you significant tax dollars.

The foregoing information is not a complete list of things to consider, but instead is a sampling. Once we discuss your individual circumstances we can determine which of these – and of the many others – apply to you

Step 1: Formulate a plan

Step 2: Make sure it’s a good one.

Let’s not minimize the importance of Step 2 there. A bad plan can be just as dangerous as no plan at all.

As always, if you have any questions whatsoever or would like to talk please call me at (540) 314-0345.

IRS Circular 230 Notice: To ensure compliance with requirements imposed by the IRS, we inform you that any federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code.