“Money is an opportunity for happiness, but it is an opportunity that people routinely squander because the things they think will make them happy often don’t”– EW Dunn

Graduating from college is one of the most significant life achievements in many people’s lives. Especially in the life of a young person – it very likely is the most important thing they have accomplished at that point in their lives. But graduation also comes with the arrival of some of life’s realities and responsibilities. Jobs have to be found, student loan repayments start, and bills appear or become due. And unfortunately it seems that many are ill-equipped to deal with these financial realities.

To help college graduates start their post-college life on the path to financial stability, I have created the following 5-step plan, complete with additional resources and actions I recommend every college graduate take.

Step 1: Choose Your Next Life Journey

If you’re one of the 83% of graduating seniors who doesn’t have a job already lined up, your first step after graduation is to decide what you will do next:

- Start your career. Many college graduates choose to search for a job related to their field of study. If you’ve chosen this option, skip down to the next section in this guide: Maximize Your Earning Potential.

- Continue your education. Continuing towards a Masters or Doctorate degree can be an excellent option for some graduates. Since only about 10% of Americans have a graduate degree, this can be a way to have an advantage when starting your career. The price tag for graduate school is typically expensive, but there are options that can potentially defray most or all of the cost through scholarships, grants, research/teaching assistantships, and other options. The value of a graduate degree can vary significantly in different fields – in some areas of study, a graduate degree will significantly increase your earning potential, but in other areas people with graduate degrees don’t earn any more than people with bachelors degrees. Take the time to analyze the benefits before you decide to pursue a higher degree. Don’t pursue a graduate degree until you’ve carefully analyzed the cost (including hidden costs such as 3-4 years of lost wages and job experience) and determined that the payoff will exceed the cost.

Tip: Don’t pursue a graduate degree until you’ve carefully analyzed the cost (including hidden costs such as 3-4 years of lost wages and job experience) and determined that the payoff will exceed the cost.

- Choose another option. Increasingly, some graduates are choosing other options, such as taking a gap year to work abroad. With careful financial planning, this path can be taken for little or no out of pocket money. The benefits offered (aside from offering fun and adventure) can benefit your career and life in many ways:

- Increases maturity

- Develops self confidence

- Expands global awareness

- Builds foreign language skills (which are commodities unto themselves)

- Increases cross-cultural and etiquette skills

- Give you a valuable perspective to contribute

- Depending on the job taken overseas, it can provide a year of professional work experience to strengthen your resume when you return

Step 2: Maximize Your Earning Potential

- Analyze your student loan debt to earning potential ratio. If you’re contemplating a master’s or doctorate degree, realize that graduate school provides a significant wage premium for certain professions but not for others. Research your particular field before making the decision to spend another two years and $30,000 (or quite a bit more in some cases) on grad school.

- Be realistic as to what position and salary you can get for your first job. College degrees are much more the norm and expectation than they were just a few decades ago. Understand this trend when you’re deciding what position to take at a company. If you do not have significant experience, do not expect to enter as upper management just because of your academic credentials. This will take time.

- But don’t settle too much. Raises and upward mobility are often based on where you start at a company. Starting in the mailroom and working your way up to CEO sounds good in theory, but it’s just as likely to stall you in a worse position and lower salary. When I was in the corporate world I had coworkers in equivalent positions earning $10-20k less than me simply because they started at much lower positions. Be balanced – not expecting to start as a senior VP but also not taking a position well below your credentials. Look for a position that will allow you to gain experience in your field and follow a clear path to advancement.

- Make it a priority to develop your real-world skills. A college education is an important career tool, but the knowledge you receive at a university is not the same as real world skills and experience. Take these steps to build up your marketable skills and increase your earning potential:

- Learn what employers want. Talk with other professionals in the field, observe your coworkers, read job postings, and ask your boss for input to find out what specific skills are in demand. Create a list of skills you’d like to acquire.

- Develop specific skills. Start taking extra time to learn the knowledge and skills on your list. In many industries, there are free or low-cost learning options available to pick up specific skills that weren’t covered in college.

- Get real world experience. Find ways to use your developing knowledge and skills in the real world – this could be at your job or even by volunteering to help a friend or non-profit.

- Attain certifications. Many industries have certifications that are available and get set you apart from the crowd. Not only do they look good on a resume, but the process will greatly increase your competence in the area of study

- Continue to grow. As you learn new things and hear about new opportunities, keep updating your list and continuing to grow.

Step 3: Realistically Pay Off Your Student Loans

On average, 2015 college graduates have $35,000 of debt when they complete their studies. With the average debt burden upon graduation rising with every year, students need a smart, specific plan to tackle their student loan payments.

College graduates need to be aware of the different approaches and tactics for paying off these loans:

- Loan consolidation. I’m not a huge fan of loan consolidation if it is avoidable. Even the government’s site mostly cautions against it since it typically just lowers your payment/increases your payoff period. Unless you have crippling payments that you simply cannot make or are going to get a better interest rate, I recommend avoiding student loan consolidation.

- Should you pay off loans, save money, or invest money? There are very good arguments for all three approaches – with mathematical/financial, behavioral, and liquidity related lines of reasoning. See Paying Off Mortgage Quickly? Not So Fast! for a comprehensive analysis of the different approaches. While the articles is specifically geared towards mortgage payments, the principles hold true for any kind of low-interest, long-term debt (including student loans).

- Get your loans paid for you. Some companies/municipalities will pay your student loans for you if you go to rural or inner city areas, places that are underserved for your trade. Even some companies that just need to attract talent will pay for your loans over time.

Step 4: Create And Live By A Budget

- Why is a budget is so important? Over 80% of college students receive financial aid from their parents, the government, or other sources. For most people that goes away after graduation and a host of new bills become due at the same time. Student loan repayments start, you have to pay for rent, you might drop off of your parents’ health insurance plan, you will pay more in income taxes, etc. If you don’t budget for all of this ahead of time, you could find yourself constantly cash strapped (or going into debt to stay afloat).

- Make a comprehensive budget ahead of time to make sure none of this catches you off-guard. We’ve created a free budget worksheet you can use to create your budget before you even graduate college.

- Don’t spend spare money on stupid stuff. This sounds basic, but it is an easy trap to fall into. Your paychecks will likely be dramatically more than they have been before. But as the new bills section below shows, that can be eaten up very quickly. More money coming in should not be an excuse to spend frivolously. You’re an adult now – it’s time to spend and save like one.

New Bills For College Graduates

Many college graduates find they have bills to pay that they never thought of before. Here is a partial list of the bills you’ll likely need to pay after graduation:

- Rent

- Electricity/Gas

- Water

- Trash collection

- Sewer

- Renters insurance

- Car payment

- Car insurance

- Car maintenance

- Car repairs

- Gas

- School loan payments

- Health insurance

- Dental insurance

- Healthcare expenses

- Food/groceries

- Home expenses

Recommended Software To Help You Budget:

If you prefer to use an app to help you budget instead of a worksheet, I recommend Mint.com. It’s a free, painless budgeting tool and a great way to keep track of all of your spending. There are more powerful softwares available (such as Quicken), but they are paid programs and typically require more manual entry. In my experience people continue using Mint.com but stall out on Quicken-esque programs eventually.

If you’re an accountant (one of the top 10 most popular degrees several years running!) then you’d love Quickbooks. But that’s massive overkill for personal finances and would set you back a pretty penny compared to the other options.

An Additional Resource I Recommend:

My favorite resource on thrift, financial planning, and personal wealth is The Richest Man in Babylon Paperback by George S. Clason. It’s a simple book and I highly recommend it.

Step 5: Start Investing Early

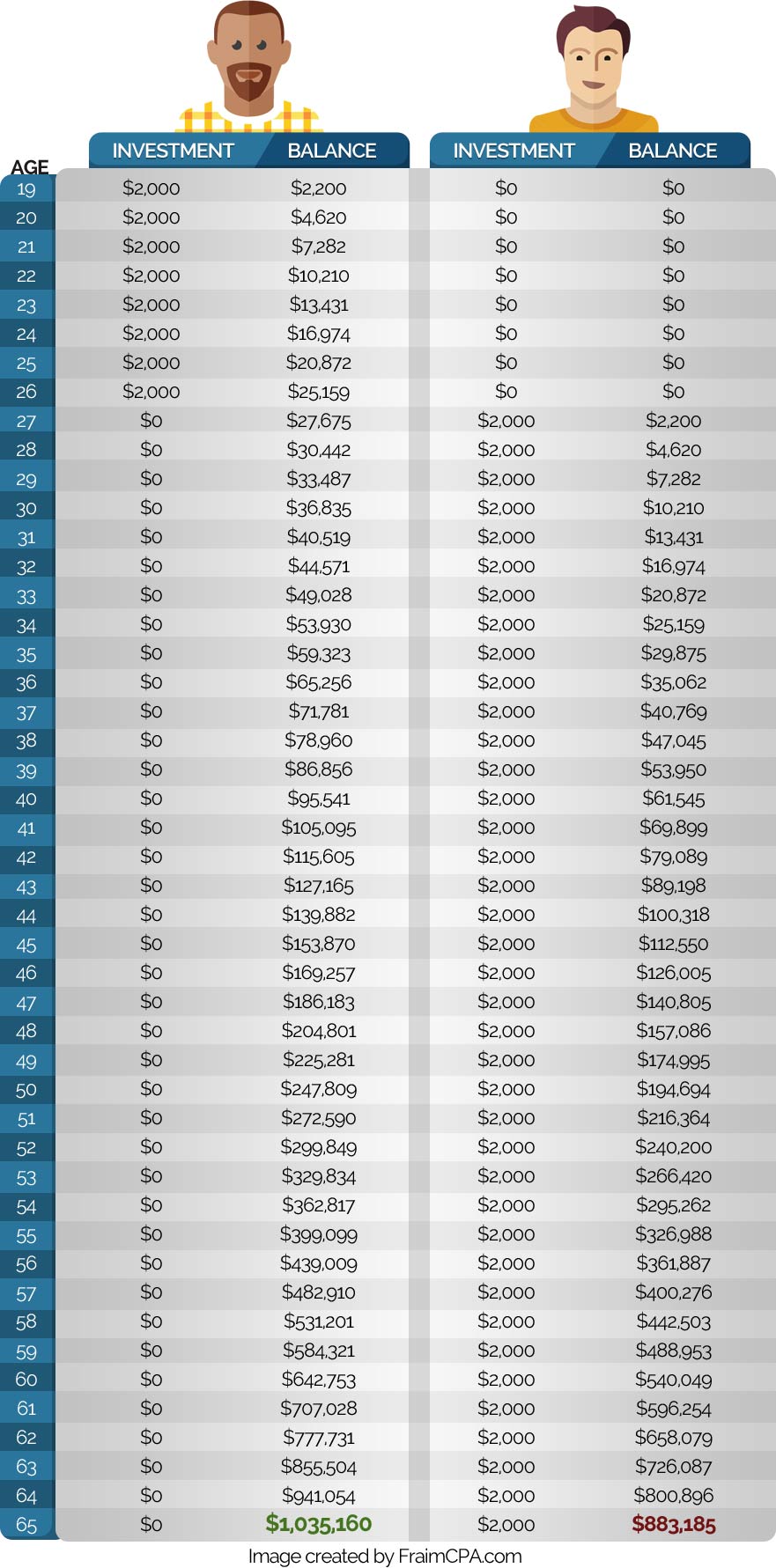

When you graduate you’ll still probably be in your early twenties, so it’s natural to think that saving and investing can wait. You have plenty of time and now is the time to enjoy yourself…right? Wrong – at least from a financial standpoint. Take a look at the chart below with two scenarios. In the first one, “David” invests $2,000 a year from age 19 to 26 and then never invests again. In the second scenario “Bruce” invests $2,000 a year from age 26 all the way to age 65. Assuming a 10% rate of return notice their ending investment balances:

Just by investing a few years sooner, David ends up with over $100,000 more than Bruce even though he invested $62,000 less. Saving and investing early pays. And not only does it make sense mathematically, it helps to ingrain a habit and behavior in you early on – the idea that “I will invest and save even if I have to give up certain wants for the time being.” This mindset will pay huge dividends as you continue doing this throughout your life. (Imagine “David” in the above illustration not just investing early on, but continuing that practice for the long-term. It’s big.)

These are just a few of the tips to consider. No single list will be all inclusive. But if you follow these tips you will be ahead of the vast majority of your peers.

Any accounting, business, or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.